Understanding the Benefits and Risks of Pool Loans for Your Financial Needs

#### What are Pool Loans?Pool loans, also known as pooled loans, refer to a financing structure where multiple borrowers come together to pool their resourc……

#### What are Pool Loans?

Pool loans, also known as pooled loans, refer to a financing structure where multiple borrowers come together to pool their resources and secure a loan. This method is often utilized for larger projects or investments, allowing individuals or businesses to share the financial burden while benefiting from potentially lower interest rates due to the collective borrowing power. Pool loans can be particularly advantageous for financing real estate developments, large-scale purchases, or even community projects.

#### Benefits of Pool Loans

One of the primary benefits of pool loans is the ability to access larger sums of money than an individual borrower might qualify for on their own. By pooling resources, participants can leverage their combined creditworthiness, which can lead to more favorable loan terms. Additionally, pool loans often come with lower interest rates compared to traditional loans, as lenders view the collective risk as more manageable.

Moreover, pool loans foster collaboration among borrowers, encouraging partnerships and shared goals. This can be particularly beneficial in real estate ventures, where multiple investors can contribute to a development project, spreading both the financial risk and the potential rewards. The pooling of resources also allows for diversification, reducing the impact of any single investment's underperformance on the overall financial health of the group.

#### Risks Associated with Pool Loans

Despite their advantages, pool loans are not without risks. One significant concern is the potential for disagreements among borrowers. Since multiple parties are involved, differing opinions on project management or financial decisions can lead to conflicts that may jeopardize the success of the loan agreement. It is crucial for all participants to have clear communication and a well-defined agreement to mitigate these risks.

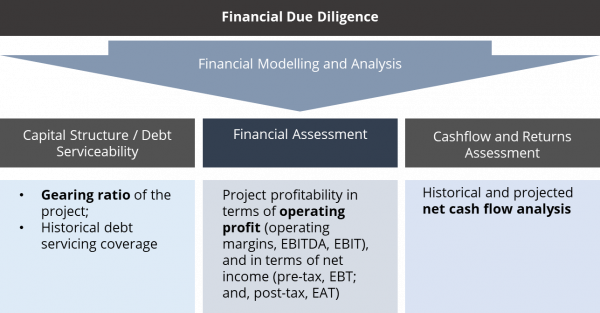

Additionally, if one borrower defaults on their portion of the loan, the remaining borrowers may be held responsible for covering that debt. This can create a financial strain on individuals who may have otherwise been able to manage their own loans effectively. Therefore, it is essential for all parties involved to conduct thorough due diligence on each other’s financial backgrounds and to establish a solid plan for repayment.

#### How to Secure a Pool Loan

Securing a pool loan typically involves several key steps. First, interested parties should identify potential collaborators who share similar financial goals and risk tolerance. Once a group is formed, the next step is to develop a comprehensive business plan outlining the purpose of the loan, the expected financial outcomes, and the roles of each participant.

After establishing a clear plan, the group should approach lenders to discuss their pooling arrangement. It is advisable to present a united front, showcasing the collective financial strength of the group. Lenders will likely require detailed financial information from all participants, so transparency is crucial.

Once a lender is secured, the group must draft a legal agreement that outlines each party's responsibilities, the terms of the loan, and the procedures for managing any potential defaults. This agreement should be reviewed by legal counsel to ensure that all parties are adequately protected.

#### Conclusion

In summary, pool loans offer a unique financing solution for groups looking to tackle larger projects or investments collaboratively. While they present several benefits, including access to larger funds and lower interest rates, they also carry inherent risks that must be carefully managed. By fostering clear communication and establishing solid agreements, borrowers can maximize the advantages of pool loans while minimizing potential pitfalls. Whether for real estate, community projects, or joint business ventures, understanding the dynamics of pool loans can lead to successful outcomes for all involved.