Understanding Principal Loan: A Comprehensive Guide to Managing Your Borrowing Wisely

Guide or Summary:What is Principal Loan?The Importance of Principal Loan in Financial PlanningHow Principal Loan Affects Your Monthly PaymentsStrategies for……

Guide or Summary:

- What is Principal Loan?

- The Importance of Principal Loan in Financial Planning

- How Principal Loan Affects Your Monthly Payments

- Strategies for Managing Your Principal Loan

- Common Types of Principal Loans

What is Principal Loan?

The term "principal loan" refers to the initial amount of money borrowed from a lender, which must be repaid over time, usually with interest. When you take out a loan, whether it’s for a mortgage, personal loan, or student loan, the principal is the core amount that you are obligated to pay back. Understanding the concept of principal is crucial for effective financial management, as it directly impacts your repayment strategy and overall financial health.

The Importance of Principal Loan in Financial Planning

When planning your finances, recognizing the significance of the principal loan is essential. The principal amount affects your monthly payments, interest accrual, and the total cost of borrowing. For instance, if you take out a $10,000 personal loan with a fixed interest rate, your principal will determine how much interest you will pay over the life of the loan. The lower the principal, the less interest you will incur, which can lead to substantial savings.

How Principal Loan Affects Your Monthly Payments

Your monthly payment on a loan is typically calculated based on the principal amount, interest rate, and loan term. The principal loan amount represents the baseline for these calculations. For example, if you have a principal loan of $20,000 at a 5% interest rate over a 5-year term, your monthly payments will be significantly different than if your principal were $15,000. Understanding this relationship can help you make informed decisions about how much to borrow and how to manage your repayments effectively.

Strategies for Managing Your Principal Loan

To manage your principal loan effectively, consider the following strategies:

1. **Make Extra Payments**: If possible, make extra payments toward the principal. This can reduce the overall interest you pay and help you pay off the loan faster.

2. **Refinance**: If you find yourself with a high-interest principal loan, consider refinancing to secure a lower interest rate. This can reduce your monthly payments and the total amount of interest paid.

3. **Choose the Right Loan Term**: Selecting a loan term that aligns with your financial goals is crucial. Shorter terms generally come with higher monthly payments but lower overall interest costs.

4. **Budget Wisely**: Ensure that your budget accommodates your loan payments. This will help you avoid late payments and potential penalties that can affect your principal balance.

Common Types of Principal Loans

There are various types of principal loans, each serving different purposes:

1. **Mortgage Loans**: These are loans taken out to purchase real estate, where the property itself serves as collateral. The principal loan amount is typically large, and repayment terms can extend over 15 to 30 years.

2. **Personal Loans**: Unsecured loans that can be used for various purposes, such as debt consolidation or home improvement. The principal loan amount can vary widely based on the lender and borrower’s creditworthiness.

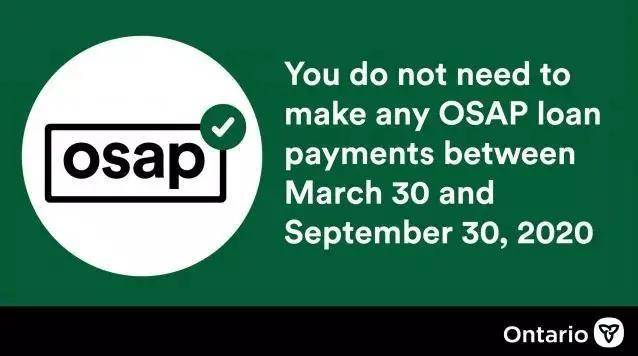

3. **Student Loans**: These loans help cover the cost of education. They often have different repayment terms and interest rates, with the principal amount being the total borrowed for tuition and related expenses.

Understanding the concept of principal loan is vital for anyone looking to navigate the world of borrowing. By grasping how the principal affects your monthly payments, total interest, and overall financial strategy, you can make more informed decisions. Whether you are considering a mortgage, personal loan, or student loan, being aware of your principal loan amount can lead to better financial outcomes. Always remember to budget wisely, consider refinancing options, and make extra payments when feasible to manage your principal loan effectively.