Unlock Quick Cash with Auto Title Loans Los Angeles: Your Fast Solution for Financial Needs

Guide or Summary:What Are Auto Title Loans?Why Choose Auto Title Loans in Los Angeles?How to Apply for Auto Title Loans in Los AngelesIn the bustling city o……

Guide or Summary:

- What Are Auto Title Loans?

- Why Choose Auto Title Loans in Los Angeles?

- How to Apply for Auto Title Loans in Los Angeles

In the bustling city of Los Angeles, where opportunities abound but financial emergencies can strike at any moment, finding a reliable source of quick cash is essential. This is where Auto Title Loans Los Angeles come into play, providing residents with a fast and efficient way to secure the funds they need without the lengthy processes associated with traditional loans.

What Are Auto Title Loans?

Auto title loans are a type of secured loan where borrowers use their vehicle title as collateral. This means that if you own a car outright and have the title to prove it, you can leverage that asset to secure a loan. The amount you can borrow typically depends on the value of your vehicle, making it a viable option for those who may not qualify for conventional loans due to poor credit or lack of income documentation.

Why Choose Auto Title Loans in Los Angeles?

Los Angeles residents often face unique financial challenges, from high living costs to unexpected expenses. Here are several compelling reasons to consider Auto Title Loans Los Angeles:

1. **Fast Approval Process**: One of the most significant advantages of auto title loans is the speed at which you can get approved. Many lenders in Los Angeles offer same-day approvals, allowing you to access cash quickly when you need it most.

2. **Minimal Documentation Required**: Unlike traditional loans that require extensive paperwork and credit checks, auto title loans typically require only a few essential documents, such as your vehicle title, ID, and proof of income. This streamlined process makes it easier for borrowers to obtain the funds they need.

3. **Keep Your Vehicle**: With Auto Title Loans Los Angeles, you can continue driving your vehicle while you repay the loan. This is particularly beneficial for those who rely on their cars for work or daily activities.

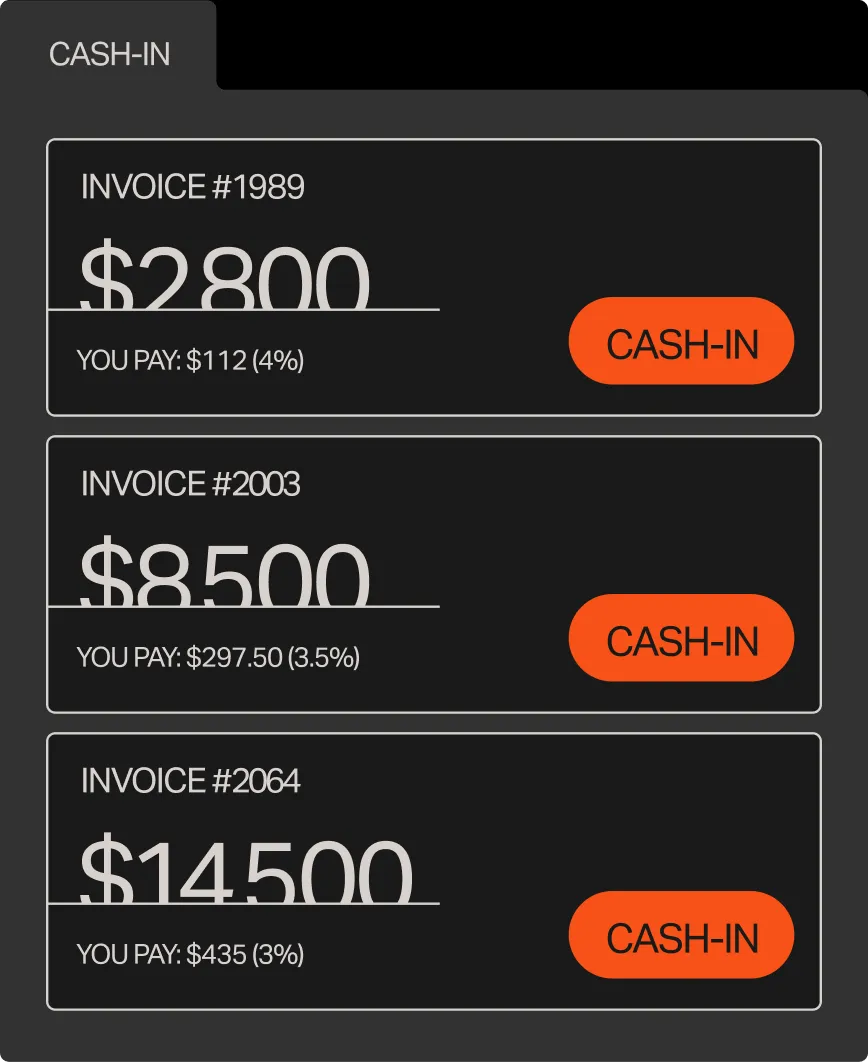

4. **Flexible Loan Amounts**: Depending on the value of your vehicle, you can borrow a significant amount of money. This flexibility allows you to choose a loan that meets your specific financial needs, whether it's for medical bills, home repairs, or other urgent expenses.

How to Apply for Auto Title Loans in Los Angeles

The application process for Auto Title Loans Los Angeles is straightforward:

1. **Online Application**: Many lenders offer online applications, allowing you to apply from the comfort of your home. Fill out the required information, including details about your vehicle and your financial situation.

2. **Vehicle Inspection**: Once your application is submitted, the lender may require a quick inspection of your vehicle to assess its value. This can often be done at a location convenient for you.

3. **Loan Offer**: After the inspection, the lender will present you with a loan offer based on your vehicle's value and your financial situation. Review the terms carefully to ensure they meet your needs.

4. **Receive Your Funds**: If you accept the loan offer, the funds can be disbursed quickly, often on the same day. You can use the cash for whatever urgent needs you have.

In times of financial distress, Auto Title Loans Los Angeles provide a quick and effective solution for residents. With fast approval times, minimal documentation, and the ability to keep your vehicle, these loans can be a lifesaver. Whether you're facing unexpected bills or need cash for an important purchase, consider leveraging your vehicle title to access the funds you need. Always remember to read the terms carefully and choose a reputable lender to ensure a positive borrowing experience.