## Unlock Your Savings with the Best Auto Loan Refinancing Options Available

When it comes to managing your finances, finding the best auto loan refinancing can make a significant difference in your monthly budget. In today’s economy……

When it comes to managing your finances, finding the best auto loan refinancing can make a significant difference in your monthly budget. In today’s economy, many car owners are looking for ways to reduce their expenses, and refinancing your auto loan is one of the most effective strategies to achieve that.

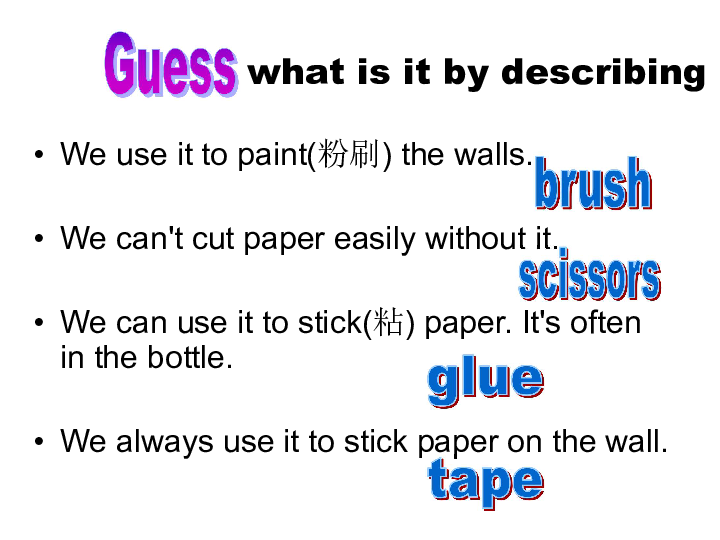

### Why Consider the Best Auto Loan Refinancing?

Refinancing your auto loan can lead to lower interest rates, reduced monthly payments, and even the opportunity to pay off your loan faster. If you initially financed your vehicle when interest rates were high or your credit score was lower, you might be eligible for a better deal now. The best auto loan refinancing options can help you save money and improve your financial situation.

### Benefits of Refinancing Your Auto Loan

1. **Lower Interest Rates**: One of the most compelling reasons to refinance is the potential for lower interest rates. If rates have dropped since you took out your original loan, or if your credit score has improved, you could qualify for a much more favorable rate. This can save you hundreds, if not thousands, over the life of the loan.

2. **Reduced Monthly Payments**: By securing a lower interest rate or extending the term of your loan, you can significantly reduce your monthly payments. This can free up cash for other expenses or allow you to save more for future goals.

3. **Improved Cash Flow**: With lower monthly payments, you can improve your cash flow, giving you the flexibility to handle other financial obligations or invest in opportunities that may arise.

4. **Shorten Loan Term**: Alternatively, if you can afford higher monthly payments, refinancing can allow you to shorten the loan term. This means you could pay off your vehicle sooner, saving on interest in the long run.

5. **Access to Better Loan Features**: Some lenders offer additional features, such as the ability to skip a payment or provide a grace period for late payments. This can be beneficial if you find yourself in a tight spot financially.

### How to Find the Best Auto Loan Refinancing

Finding the best auto loan refinancing options involves several steps:

- **Research Lenders**: Start by researching various lenders, including banks, credit unions, and online lenders. Each may offer different rates and terms, so it's essential to compare multiple options.

- **Check Your Credit Score**: Before applying for refinancing, check your credit score. A higher score can qualify you for better rates. If your score has improved since you took out your original loan, you may be in a strong position to negotiate.

- **Gather Necessary Documentation**: When you find a lender you’re interested in, gather all necessary documentation, including proof of income, vehicle information, and your current loan details. This will streamline the application process.

- **Apply for Pre-Approval**: Many lenders offer pre-approval, which allows you to see what rates you qualify for without impacting your credit score. This step can help you make a more informed decision.

- **Read the Fine Print**: Once you receive offers, carefully read the terms and conditions. Look out for hidden fees or penalties that could affect your overall savings.

### Conclusion

In conclusion, the best auto loan refinancing can offer numerous benefits that can lead to significant savings and improved financial health. By understanding your options and taking the time to research lenders, you can unlock the potential to lower your monthly payments, reduce your interest rate, and even pay off your vehicle sooner. Don't hesitate to explore the best auto loan refinancing opportunities available to you today. Your wallet will thank you!