Unlock Your Dream Home with Affordable Home Loans Omaha NE: Your Guide to Financing in Nebraska

When it comes to purchasing a home in Omaha, Nebraska, understanding the ins and outs of home loans Omaha NE can make all the difference. Whether you're a f……

When it comes to purchasing a home in Omaha, Nebraska, understanding the ins and outs of home loans Omaha NE can make all the difference. Whether you're a first-time homebuyer or looking to refinance, having the right information at your fingertips is crucial. In this comprehensive guide, we will explore the various types of home loans available in Omaha, the application process, and tips for securing the best rates.

#### Understanding Home Loans Omaha NE

Home loans, also known as mortgages, are financial products that allow individuals to borrow money to purchase a home. In Omaha, various lenders offer a range of loan options tailored to meet different needs. Understanding these options is the first step in making an informed decision.

1. **Conventional Loans**: These are the most common type of home loans and are not backed by the government. They typically require a higher credit score and a larger down payment but offer competitive interest rates.

2. **FHA Loans**: Backed by the Federal Housing Administration, FHA loans are designed for low-to-moderate-income borrowers. They require a lower down payment and are more forgiving of lower credit scores, making them an excellent option for first-time homebuyers.

3. **VA Loans**: If you are a veteran or an active-duty service member, you may qualify for a VA loan. These loans offer favorable terms, including no down payment and no private mortgage insurance (PMI).

4. **USDA Loans**: For those looking to buy in rural areas, USDA loans offer zero down payment options for eligible buyers. These loans are aimed at promoting homeownership in less densely populated areas.

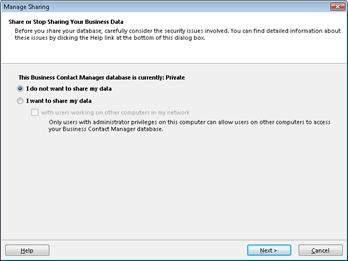

#### The Application Process for Home Loans Omaha NE

Navigating the application process for home loans Omaha NE can seem daunting, but breaking it down into manageable steps can help simplify the experience:

1. **Check Your Credit Score**: Before applying, check your credit score. Most lenders require a score of at least 620 for conventional loans, while FHA loans may allow scores as low as 580.

2. **Gather Documentation**: Prepare your financial documents, including tax returns, pay stubs, and bank statements. This information will help lenders assess your financial situation.

3. **Pre-Approval**: Seek pre-approval from lenders. This step not only gives you a better idea of how much you can borrow but also shows sellers that you are a serious buyer.

4. **Choose the Right Lender**: Research various lenders and compare their interest rates, fees, and customer service. Look for lenders with experience in home loans Omaha NE.

5. **Submit Your Application**: Once you've chosen a lender, submit your application along with the required documentation.

6. **Loan Processing and Underwriting**: After submission, your application will go through processing and underwriting. This step involves verifying your information and assessing the risk of lending to you.

7. **Closing**: If approved, you’ll move on to closing, where you’ll sign the final paperwork and receive the keys to your new home.

#### Tips for Securing the Best Home Loans Omaha NE

To ensure you get the best deal on your home loans Omaha NE, consider the following tips:

- **Improve Your Credit Score**: Before applying, work on improving your credit score by paying down debts and making payments on time.

- **Shop Around**: Don't settle for the first offer. Compare rates and terms from multiple lenders to find the best deal.

- **Understand the Fees**: Be aware of any additional fees that may come with the loan, including closing costs and PMI.

- **Consider a Larger Down Payment**: If possible, a larger down payment can help you secure a lower interest rate and reduce your monthly payments.

In conclusion, navigating the world of home loans Omaha NE doesn't have to be overwhelming. By understanding your options, preparing adequately, and seeking the best rates, you can unlock the door to your dream home in Omaha, Nebraska. Whether you’re a first-time buyer or looking to refinance, the right loan can set you on the path to homeownership.