### What is Considered a Jumbo Home Loan? A Comprehensive Guide to Understanding Jumbo Loans

#### What is Considered a Jumbo Home Loan?A **jumbo home loan** is a type of mortgage that exceeds the limits set by the Federal Housing Finance Agency (FHF……

#### What is Considered a Jumbo Home Loan?

A **jumbo home loan** is a type of mortgage that exceeds the limits set by the Federal Housing Finance Agency (FHFA) for conforming loans. These loans are not eligible for purchase by Fannie Mae or Freddie Mac, the government-sponsored enterprises that buy and securitize mortgages. Because of this, jumbo loans typically come with stricter credit requirements and higher interest rates compared to conforming loans.

#### The Basics of Jumbo Home Loans

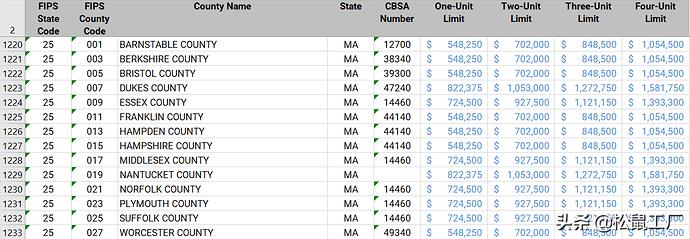

When discussing **what is considered a jumbo home loan**, it's essential to understand the loan limits that define them. As of 2023, the conforming loan limit for a single-family home in most areas is $726,200. However, in high-cost areas, this limit can be significantly higher, reaching up to $1,089,300 or more. Any loan amount that exceeds these limits is classified as a jumbo loan.

#### Key Features of Jumbo Loans

1. **Higher Loan Amounts**: Jumbo loans allow borrowers to secure larger amounts of financing, which is particularly beneficial in expensive real estate markets.

2. **Stricter Qualification Criteria**: Due to the higher risk associated with jumbo loans, lenders often require a higher credit score, typically 700 or above, and a lower debt-to-income ratio.

3. **Higher Interest Rates**: Jumbo loans may come with slightly higher interest rates compared to conforming loans. This is because they are not backed by government-sponsored enterprises, making them riskier for lenders.

4. **Down Payment Requirements**: Jumbo loans often require larger down payments, sometimes as much as 20% or more, depending on the lender and the borrower's financial profile.

5. **Limited Availability**: Not all lenders offer jumbo loans, and those that do may have specific eligibility criteria and documentation requirements.

#### Benefits of Jumbo Loans

Understanding **what is considered a jumbo home loan** also involves recognizing the advantages they offer. Jumbo loans provide the opportunity to purchase high-value properties that may not be attainable through conventional financing. They can also be beneficial for buyers looking to refinance existing loans into a lower interest rate or consolidate debt.

#### Risks and Considerations

While jumbo loans can be advantageous, they also come with risks. The stricter qualification criteria can make it challenging for some borrowers to qualify. Additionally, the higher interest rates and down payment requirements can strain a buyer's finances. It's crucial for potential borrowers to carefully assess their financial situation and consult with a mortgage professional to determine if a jumbo loan is the right fit.

#### Conclusion

In summary, understanding **what is considered a jumbo home loan** is vital for anyone looking to navigate the high-end real estate market. These loans offer unique opportunities for buyers but come with specific requirements and risks. By being informed about the characteristics, benefits, and potential drawbacks of jumbo loans, you can make better financial decisions when it comes to purchasing your dream home. Always consult with a financial advisor or mortgage professional to ensure that you are making the best choice for your financial future.