Comprehensive Guide to PPP Loan Information: Everything You Need to Know About the Paycheck Protection Program

#### PPP Loan InformationThe Paycheck Protection Program (PPP) was established in response to the economic impact of the COVID-19 pandemic, aimed at providi……

#### PPP Loan Information

The Paycheck Protection Program (PPP) was established in response to the economic impact of the COVID-19 pandemic, aimed at providing financial assistance to small businesses. Understanding PPP loan information is crucial for business owners seeking to navigate this program effectively. This guide will delve into the essential aspects of PPP loans, including eligibility, application processes, forgiveness criteria, and recent updates.

#### What is the Paycheck Protection Program?

The Paycheck Protection Program is a loan initiative backed by the U.S. Small Business Administration (SBA) designed to help small businesses maintain their workforce and cover essential expenses during the pandemic. The program offers loans that can be partially or fully forgiven, provided that the funds are used for qualifying expenses.

#### Eligibility for PPP Loans

To qualify for a PPP loan, businesses must meet certain criteria. Generally, eligible entities include small businesses, sole proprietorships, independent contractors, and certain non-profit organizations. The business must have been operational before February 15, 2020, and must have experienced a reduction in revenue due to the pandemic.

Additionally, businesses must provide documentation to demonstrate their payroll costs, which are critical in determining the loan amount. Understanding the eligibility requirements will help business owners assess their chances of obtaining funding.

#### Application Process for PPP Loans

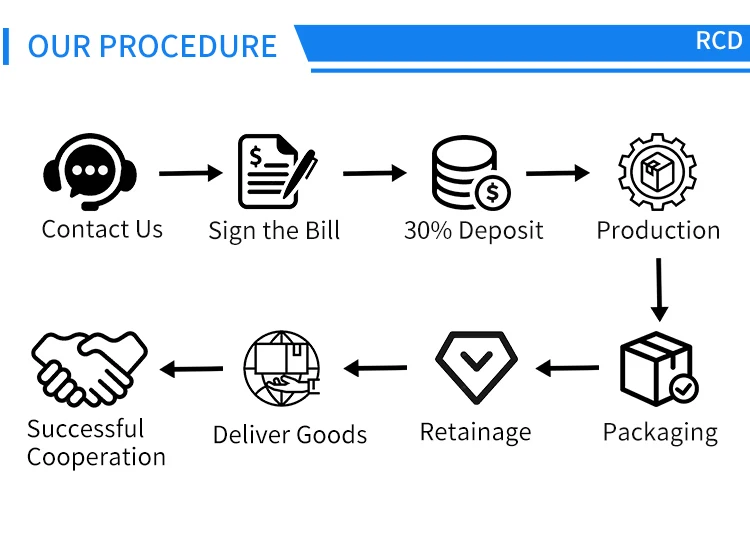

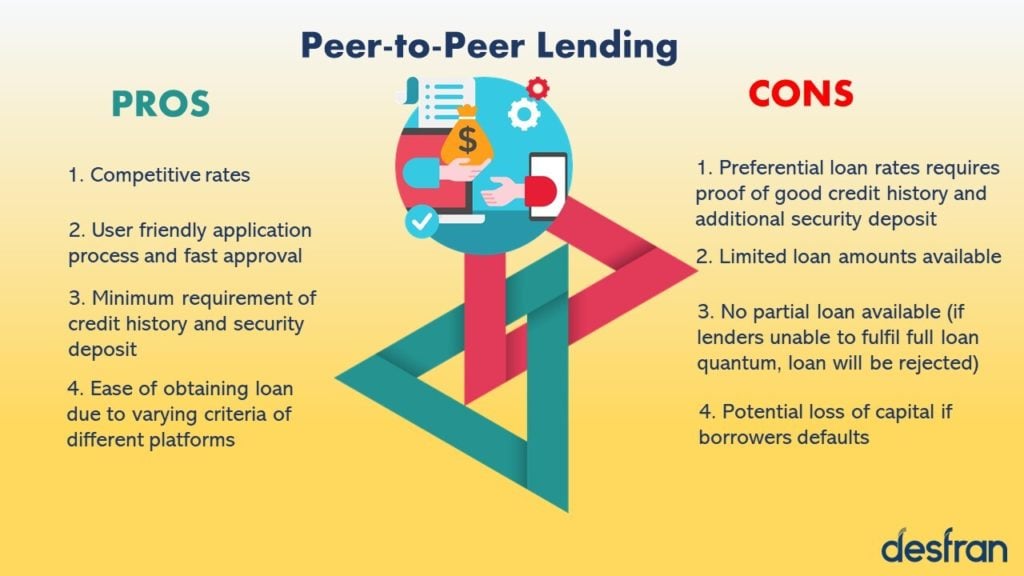

The application process for PPP loans involves several steps. Business owners must apply through an approved lender, which can include banks, credit unions, and other financial institutions. It’s essential to gather all necessary documentation, such as payroll records, tax filings, and financial statements, to support the application.

Once the application is submitted, lenders will review the information and determine the loan amount based on the applicant's average monthly payroll costs, multiplied by 2.5. The entire process can be completed online, making it accessible for many businesses.

#### Forgiveness of PPP Loans

One of the most attractive features of the PPP is the potential for loan forgiveness. To qualify for forgiveness, businesses must use at least 60% of the loan amount for payroll costs, with the remainder allocated to eligible non-payroll expenses such as rent, utilities, and mortgage interest.

Businesses must also maintain their employee headcount and salary levels to maximize their forgiveness amount. Understanding the forgiveness criteria is critical for business owners to ensure they comply with the requirements and avoid repayment of the loan.

#### Recent Updates and Changes to the PPP

As the situation surrounding the COVID-19 pandemic evolves, the PPP has undergone several changes. It’s essential for business owners to stay informed about any updates or extensions to the program. New legislation may introduce additional funding, changes to eligibility, or modifications to the forgiveness process.

#### Conclusion

In summary, understanding PPP loan information is vital for small business owners looking to leverage this financial assistance program. By familiarizing themselves with the eligibility criteria, application process, and forgiveness requirements, businesses can position themselves for success in securing funding. As the landscape continues to change, staying updated on the latest developments will ensure that businesses can take full advantage of the resources available to them.