Unlocking Opportunities: How Neighborhood Loans Can Transform Your Community

Guide or Summary:Understanding Neighborhood LoansThe Importance of Neighborhood LoansHow to Access Neighborhood LoansThe Positive Impact of Neighborhood Loa……

Guide or Summary:

- Understanding Neighborhood Loans

- The Importance of Neighborhood Loans

- How to Access Neighborhood Loans

- The Positive Impact of Neighborhood Loans

Neighborhood Loans (社区贷款) have emerged as a vital financial resource for individuals and families looking to improve their living situations and invest in their communities. In this article, we will explore the significance of neighborhood loans, how they work, and the positive impact they can have on local neighborhoods.

Understanding Neighborhood Loans

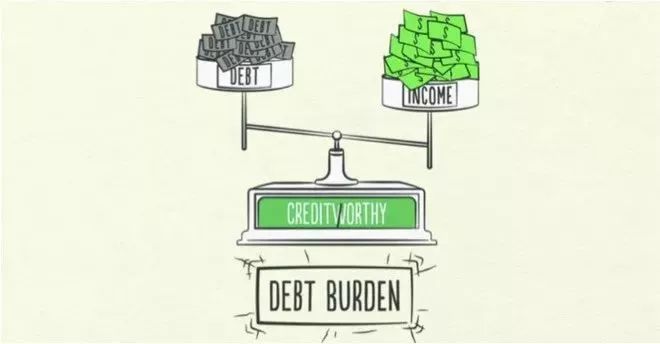

Neighborhood loans are specialized financial products designed to support residents in specific communities. These loans can be used for various purposes, including home purchases, renovations, and small business development. The goal is to provide accessible funding options to individuals who may not qualify for traditional loans due to credit history or income constraints.

Typically, neighborhood loans are offered by local banks, credit unions, or community development financial institutions (CDFIs) that focus on serving low-to-moderate-income neighborhoods. By offering competitive interest rates and flexible repayment terms, these loans empower residents to invest in their homes and local businesses, fostering economic growth and stability within the community.

The Importance of Neighborhood Loans

Neighborhood loans play a crucial role in revitalizing communities. They help residents achieve homeownership, which can lead to increased property values and a more stable neighborhood. When individuals invest in their homes, they are more likely to take pride in their community, leading to better maintenance of properties and a stronger sense of belonging.

Moreover, neighborhood loans can stimulate local economies by providing funding for small businesses. Entrepreneurs in the community can access the capital they need to start or expand their businesses, creating jobs and contributing to the local tax base. This economic activity not only benefits the business owners but also enhances the overall quality of life for residents.

How to Access Neighborhood Loans

Accessing neighborhood loans typically involves a few key steps. First, potential borrowers should research local lenders that offer these specialized loan products. Many community banks and credit unions have programs specifically designed for neighborhood loans.

Next, applicants will need to gather the necessary documentation, which may include proof of income, credit history, and information about the property or business they wish to finance. It’s essential to demonstrate the ability to repay the loan, even if the applicant has a less-than-perfect credit score.

Once the application is submitted, lenders will review the information and determine eligibility. If approved, borrowers can expect favorable terms, including lower interest rates and flexible repayment options, making it easier to manage their financial commitments.

The Positive Impact of Neighborhood Loans

The impact of neighborhood loans extends beyond individual borrowers. When residents invest in their homes and businesses, the entire community benefits. Improved properties can lead to higher property values, attracting new residents and businesses to the area. This influx can create a positive cycle of investment and growth, further enhancing the neighborhood's appeal.

Additionally, neighborhood loans can foster community engagement. As residents take pride in their homes and businesses, they are more likely to participate in local events, volunteer efforts, and other community-building activities. This engagement strengthens social ties and creates a more vibrant, connected community.

In conclusion, neighborhood loans are a powerful tool for transforming local communities. By providing accessible financing options, these loans empower residents to invest in their homes and businesses, driving economic growth and fostering a sense of community pride. As more individuals take advantage of neighborhood loans, the potential for positive change in communities across the country continues to grow.