Understanding Home Loan Equity Rates: A Comprehensive Guide to Maximizing Your Home Equity

#### What are Home Loan Equity Rates?Home loan equity rates refer to the interest rates associated with home equity loans and home equity lines of credit (H……

#### What are Home Loan Equity Rates?

Home loan equity rates refer to the interest rates associated with home equity loans and home equity lines of credit (HELOCs). These rates can vary significantly based on several factors, including the lender, the borrower's credit score, and the overall economic environment. Understanding these rates is crucial for homeowners looking to leverage their property’s value for financial needs.

#### The Importance of Home Loan Equity Rates

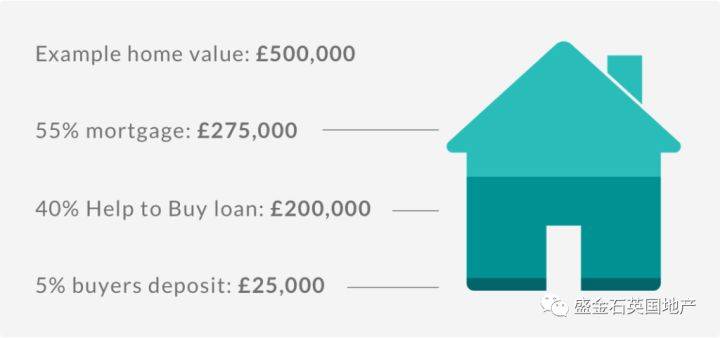

Home loan equity rates play a vital role in determining how much you can borrow against your home’s equity. Home equity is the difference between your home's current market value and the outstanding balance on your mortgage. As home values increase, so does your equity, which can be tapped into for various purposes, such as home improvements, debt consolidation, or funding major expenses like education or medical bills.

When considering a home equity loan or HELOC, the interest rate is a key factor that affects your monthly payments and the overall cost of borrowing. Lower rates can save you a significant amount of money over the life of the loan, making it essential to shop around and compare offers from different lenders.

#### Factors Influencing Home Loan Equity Rates

Several factors influence home loan equity rates, including:

1. **Credit Score**: A higher credit score typically qualifies you for lower interest rates. Lenders view borrowers with good credit as less risky, which can lead to better loan terms.

2. **Loan-to-Value Ratio (LTV)**: This ratio compares the amount of the loan to the appraised value of the home. A lower LTV indicates less risk for the lender, often resulting in lower rates.

3. **Market Conditions**: Economic factors such as inflation, the Federal Reserve's interest rate decisions, and overall demand for loans can affect home equity rates.

4. **Type of Loan**: Fixed-rate home equity loans generally offer stability in payments, while variable-rate HELOCs can fluctuate based on market conditions, impacting overall costs.

#### How to Secure the Best Home Loan Equity Rates

To secure the best home loan equity rates, consider the following strategies:

1. **Improve Your Credit Score**: Pay down debts, make payments on time, and avoid new credit inquiries to boost your score before applying.

2. **Shop Around**: Don’t settle for the first offer. Compare rates from multiple lenders, including banks, credit unions, and online lenders.

3. **Consider Timing**: Interest rates can fluctuate based on market conditions. Keep an eye on trends and consider applying when rates are lower.

4. **Negotiate**: Don’t hesitate to negotiate with lenders. If you receive a better offer from another institution, use it as leverage to potentially lower your rate.

#### Conclusion

Understanding home loan equity rates is essential for any homeowner considering tapping into their home’s equity. By being informed about what these rates entail and how they are influenced, you can make better financial decisions that align with your goals. Whether you’re looking to renovate your home, consolidate debt, or cover unexpected expenses, knowing how to navigate home loan equity rates will empower you to maximize your home’s value effectively. Always remember to do your due diligence and consult with financial advisors if necessary to ensure that you are making the best choices for your financial future.