A Comprehensive Guide on How to Get the VA Home Loan: Step-by-Step Process and Essential Tips

Guide or Summary:Understanding Eligibility for the VA Home LoanGathering Necessary DocumentationChoosing the Right LenderApplying for the VA Home LoanUnders……

Guide or Summary:

- Understanding Eligibility for the VA Home Loan

- Gathering Necessary Documentation

- Choosing the Right Lender

- Applying for the VA Home Loan

- Understanding the VA Loan Benefits

- Closing the Loan

- Final Thoughts

---

**How to get the VA home loan** (如何获得VA房贷)

The VA Home Loan program is a fantastic benefit for veterans, active service members, and certain members of the National Guard and Reserves. This program, administered by the U.S. Department of Veterans Affairs, allows eligible individuals to purchase homes without the need for a down payment, making homeownership more accessible. In this guide, we will explore the essential steps and tips on how to get the VA home loan.

.png)

Understanding Eligibility for the VA Home Loan

Before you can apply for a VA home loan, it’s crucial to determine if you meet the eligibility requirements. Generally, veterans who have served in the military and have received an honorable discharge are eligible. Additionally, active duty service members and certain members of the National Guard and Reserves may also qualify. To confirm your eligibility, you will need to obtain a Certificate of Eligibility (COE) from the VA. This document verifies your service and eligibility for the loan program.

Gathering Necessary Documentation

Once you have confirmed your eligibility, the next step in how to get the VA home loan is to gather all necessary documentation. This typically includes proof of service, such as your DD Form 214, income verification documents, and credit history. Lenders will assess your financial stability and creditworthiness, so having your documents organized and ready can streamline the process. It’s also a good idea to check your credit score beforehand, as a higher score can lead to better loan terms.

Choosing the Right Lender

Not all lenders offer VA home loans, so it’s important to shop around and find one that does. Look for lenders who have experience with VA loans, as they will be more familiar with the specific requirements and processes involved. Compare interest rates, fees, and customer service reviews to make an informed decision. Many veterans find that credit unions or specialized mortgage companies offer competitive rates and excellent service for VA loans.

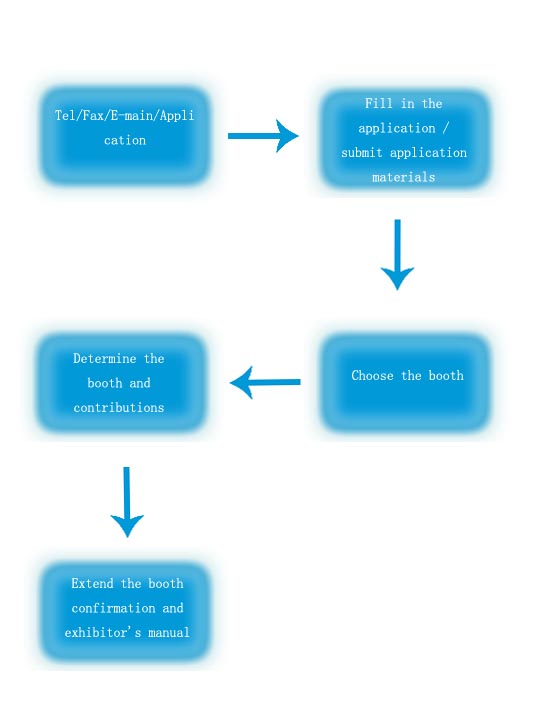

Applying for the VA Home Loan

After selecting a lender, you can begin the application process. This typically involves filling out a loan application and providing the documentation you gathered earlier. The lender will review your application, verify your information, and assess your financial situation. Be prepared to answer questions regarding your income, employment history, and any debts you may have. Once your application is approved, you will receive a loan estimate detailing the terms of the loan, including interest rates and closing costs.

Understanding the VA Loan Benefits

One of the main advantages of the VA home loan is that it does not require a down payment, which can be a significant barrier for many homebuyers. Additionally, VA loans do not require private mortgage insurance (PMI), which can save you money on monthly payments. The interest rates on VA loans are often lower than conventional loans, making them an attractive option for many veterans. Understanding these benefits can help you make the most of your VA home loan experience.

Closing the Loan

Once you have agreed to the loan terms, the next step is closing the loan. This process involves signing all necessary documents and paying any closing costs. Your lender will guide you through this process, ensuring that everything is in order. After closing, you will officially be a homeowner, and you can start enjoying the benefits of your new VA loan.

Final Thoughts

In summary, knowing how to get the VA home loan involves understanding your eligibility, gathering documentation, choosing the right lender, and navigating the application and closing processes. By following these steps and taking advantage of the benefits offered by the VA loan program, you can achieve your dream of homeownership. Whether you’re a first-time homebuyer or looking to refinance, the VA home loan is a valuable resource for veterans and service members alike. If you have any questions or need assistance, don't hesitate to reach out to your lender or a VA housing counselor for guidance.