Maximize Your Savings with a 15-Year Loan Calculator: The Ultimate Guide

Guide or Summary:Understanding the 15-Year MortgageThe Importance of a 15-Year Loan CalculatorHow to Use a 15-Year Loan CalculatorBenefits of a 15-Year Loan……

Guide or Summary:

- Understanding the 15-Year Mortgage

- The Importance of a 15-Year Loan Calculator

- How to Use a 15-Year Loan Calculator

- Benefits of a 15-Year Loan

When it comes to managing your finances, understanding the implications of different loan terms is crucial. One of the most effective ways to do this is by utilizing a 15-year loan calculator. This powerful tool can help you analyze your mortgage options and determine the most cost-effective choice for your home financing needs. In this article, we will delve into the benefits of a 15-year mortgage, how to use a loan calculator effectively, and why it can be a game changer for your financial future.

Understanding the 15-Year Mortgage

A 15-year mortgage is a home loan that is paid off over a period of 15 years. This type of mortgage typically comes with lower interest rates compared to 30-year loans, which can save you a significant amount of money in interest payments over the life of the loan. Additionally, because the loan term is shorter, you build equity in your home more quickly, which can be advantageous if you decide to sell or refinance in the future.

The Importance of a 15-Year Loan Calculator

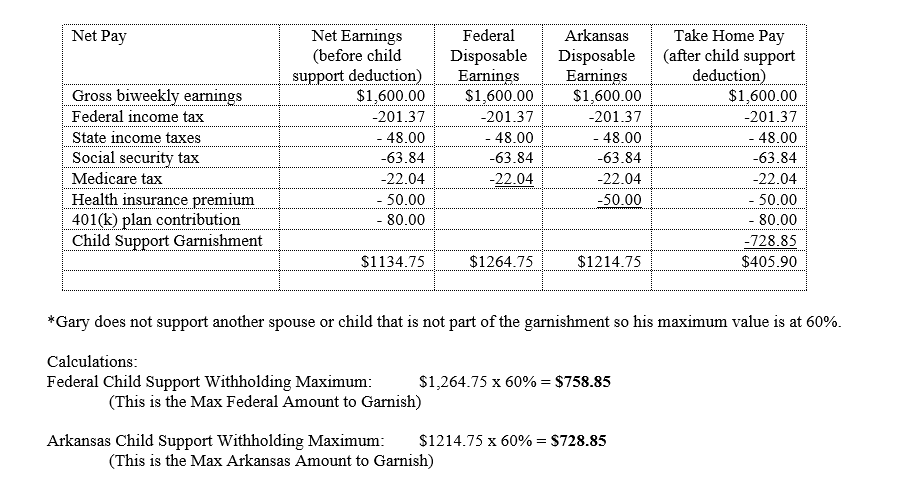

Using a 15-year loan calculator allows you to input various loan amounts, interest rates, and down payments to see how these factors affect your monthly payments and total interest paid. This can provide clarity on what you can afford and help you make informed decisions. By adjusting different variables, you can visualize how a smaller down payment or a slightly higher interest rate will impact your overall financial situation.

How to Use a 15-Year Loan Calculator

To effectively use a 15-year loan calculator, follow these steps:

1. **Input the Loan Amount**: Start by entering the total amount you plan to borrow. This will typically be the purchase price of the home minus your down payment.

2. **Enter the Interest Rate**: Input the current interest rate you expect to receive. Interest rates can vary based on your credit score and market conditions, so it’s wise to shop around.

3. **Specify Your Down Payment**: If you’re making a down payment, enter that amount. A larger down payment can reduce your monthly payments and the total interest paid over the life of the loan.

4. **Review the Results**: Once you input all the necessary information, the calculator will provide you with your estimated monthly payment, total interest paid, and the total cost of the loan. This information can guide your decision-making process.

Benefits of a 15-Year Loan

Choosing a 15-year mortgage has several advantages:

- **Lower Interest Rates**: Lenders typically offer lower rates for 15-year loans, which can result in substantial savings.

- **Faster Equity Building**: With a shorter loan term, you build equity in your home more quickly, which can be beneficial if you plan to sell or refinance in the future.

- **Less Interest Paid**: Over the life of the loan, you will pay significantly less in interest compared to a 30-year mortgage.

In conclusion, using a 15-year loan calculator is an essential step in the home-buying process. It empowers you to make informed financial decisions by providing a clear picture of your mortgage options. By understanding the benefits of a 15-year mortgage and leveraging the insights gained from a loan calculator, you can maximize your savings and achieve your homeownership goals with confidence. Whether you are a first-time homebuyer or looking to refinance, this tool is invaluable in navigating the complexities of mortgage financing.