Maximize Your Savings with a 10 Year Boat Loan Calculator: A Comprehensive Guide

#### Understanding the 10 Year Boat Loan CalculatorA **10 year boat loan calculator** is an essential tool for anyone considering financing a boat purchase……

#### Understanding the 10 Year Boat Loan Calculator

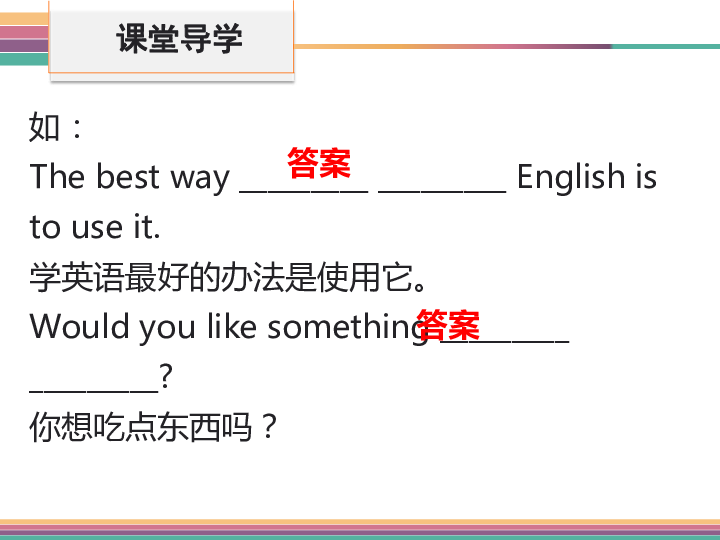

A **10 year boat loan calculator** is an essential tool for anyone considering financing a boat purchase over a decade. This calculator allows potential buyers to estimate monthly payments, total interest paid, and the overall cost of the loan. By inputting variables such as the loan amount, interest rate, and loan term, users can gain insights into their financing options, helping them make informed decisions.

#### Benefits of Using a 10 Year Boat Loan Calculator

Using a **10 year boat loan calculator** offers several advantages. Firstly, it simplifies the financial planning process by providing clear estimates of monthly payments. This allows buyers to budget effectively and avoid overstretching their finances. Secondly, it helps in comparing different loan offers by adjusting the interest rates and loan terms. Users can easily see how these changes affect their monthly payments and total loan costs.

#### How to Use the 10 Year Boat Loan Calculator

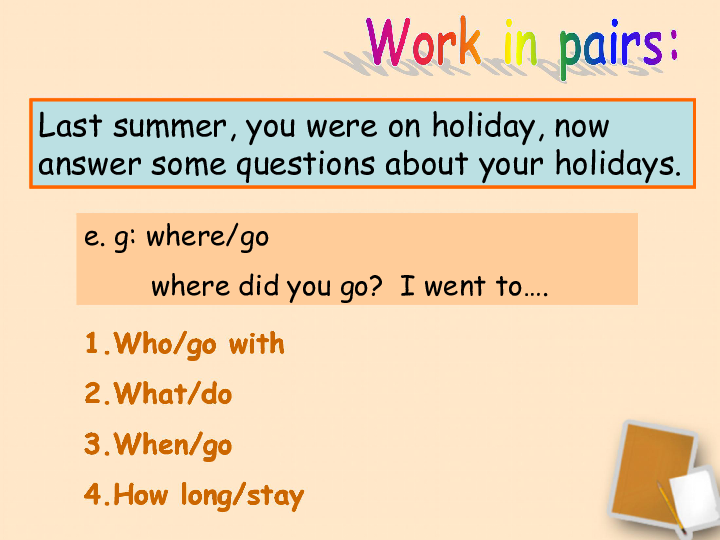

To utilize a **10 year boat loan calculator**, follow these simple steps:

1. **Input the Loan Amount**: Enter the total amount you wish to borrow for your boat purchase.

2. **Select the Interest Rate**: Input the annual interest rate offered by lenders. This rate can vary based on credit scores and market conditions.

3. **Choose the Loan Term**: Set the loan term to 10 years, as this will help you calculate the payments over this specific period.

4. **Calculate**: Click the calculate button to see your estimated monthly payments, total interest paid, and the overall cost of the loan.

#### Factors to Consider When Using a 10 Year Boat Loan Calculator

While a **10 year boat loan calculator** is a powerful tool, it’s important to consider additional factors that can influence your loan experience:

- **Credit Score**: Your credit score plays a significant role in determining the interest rate you will be offered. A higher score can lead to lower rates, which in turn reduces your monthly payments and total interest.

- **Down Payment**: The size of your down payment can also affect your loan amount. A larger down payment reduces the amount you need to finance, resulting in lower monthly payments.

- **Loan Type**: Different types of loans (fixed vs. variable interest rates) can impact your overall cost. Fixed-rate loans offer stability, while variable rates may start lower but can increase over time.

#### Conclusion: Make Informed Decisions with the 10 Year Boat Loan Calculator

In conclusion, a **10 year boat loan calculator** is an invaluable resource for prospective boat buyers. It empowers you to make informed financial decisions, ensuring that you choose a loan that fits your budget and long-term financial goals. By understanding how to use the calculator and considering the various factors that influence your loan, you can embark on your boating adventure with confidence and clarity. Whether you are a first-time buyer or looking to upgrade, leveraging this tool can significantly enhance your purchasing experience.